An interview with Billie Lau: Author of Banker 食堂

Billie Lau has been reporting on the Hong Kong banking and finance sector for more than 25 years, having worked at the Hong Kong Economic Journal, Hong Kong Economic Times, Oriental Daily News, and Apple Daily over the course of her career. She’s held a range of senior positions during this period and received several awards for her work.

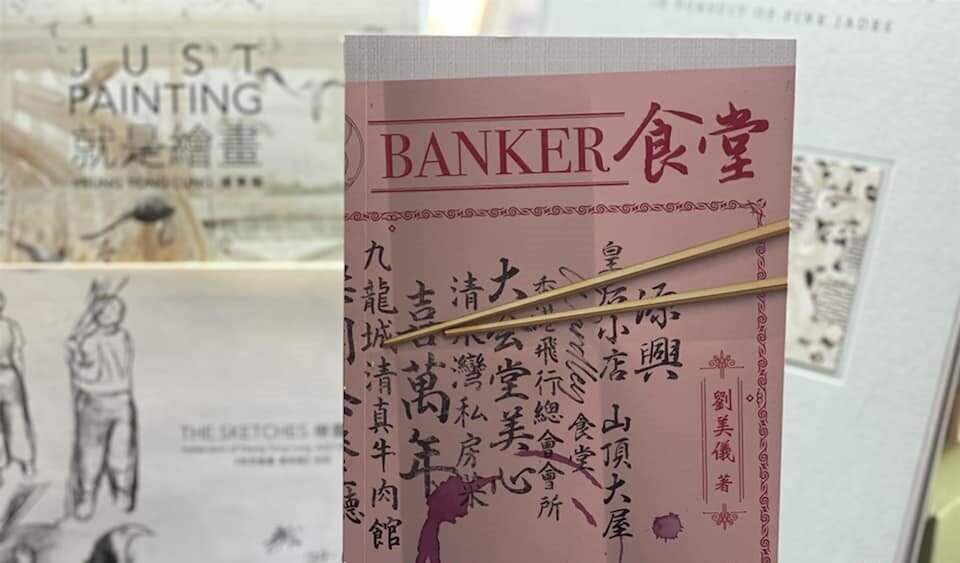

Billie recently published Banker食堂, a wide-ranging book featuring interviews and stories from Hong Kong’s banking sector. This interview is an exploration of Billie’s motivations for writing the book and a dive into her experience and perspective.

To start, what motivated you to write this book? What did you feel the reading public needed to know?

I was deeply inspired by the Japanese TV series namely ‘Midnight Diner’, 深夜食堂 which was shot many years ago. The story originated from a manga of the same name, where people finished their daily work and hung around the street stalls sharing about the ups and downs of life, the challenges they encountered and the difficulties they struggled with.

I strongly believe that even during the hard times of life, people who have faith and courage will be able to recognise the goodness in others. With that perspective, there shouldn’t be any difference between the world of commoners and the elite. It is this conviction that drove me to start doing the interviews that would later become the stories featured in “Banker 食堂”.

In the first part of the book, you interview bankers at restaurants and in their home kitchens. How does Hong Kong’s food and restaurant culture help us understand more about the banking sector?

One of the highlights of the book describes bankers crossing paths with strangers over simple meals at street corner snack bars, and how those in the industry found healing and strength in listening to one another's life stories. But one will notice in reading that the food and eateries are only the intermediaries, what matters are the memories and the people who make them.

As flowers blossom and wither, restaurants open and shut down, and in Hong Kong this process has been witness to the evolution of the banking world and the city’s status as an international financial hub.

For example, Yuen Hing Restaurant源興茶餐廳 in Central used to be the most popular midnight dining hangout for the forex dealers of overnight trading desks. But this memorable scene no longer exists with the shrinking of local forex trading volumes.

You also include personal interviews that span a wide range of topics. What would you say were the biggest takeaways from these discussions?

These discussions were enlightening. As the saying goes, one cannot step into the same river twice. Amid a constantly changing and uncertain market environment, financial institutions and industry participants have to tackle every challenge with strength and flexibility – like adapting to the sudden emergence of a strong wind. Throughout the process, you may come to respect the inevitability of fate or adopt a living belief in the conviction that you can change the course of events.

Can you describe how you’ve managed such close relationships with the local banking community over the years? What would you say are the keys to building and maintaining trusted relationships?

Being a banking and finance journalist for over 25 years (an ‘oldie’, some might say), I have always found that mutual respect is the key element in building two-way relationships. A commitment to continuously enhancing one’s professional knowledge, skills and working capabilities is also essential. We should be neither self-abasing nor arrogant, 不卑不亢. Respect is earned, not given.

How do you think the banking industry in Hong Kong is changing? What are the most important stories yet to be told?

The banking industry and regulatory landscapes have been changing drastically since the collapse of Lehman Brothers (and the ensuing financial crisis), the rise of competition from FinTech companies and the trend of digital transformation. To achieve a reasonable level of return on tangible equity with a sustainability focus is definitely a difficult task for the industry in the future. In addition, banks have to address the additional challenges emerging from the COVID-19 crisis and get ready to position themselves in the post-pandemic environment.

What would you say has been the greatest lesson from your years reporting on the banking industry?

The greatest lesson I’ve learnt over the years is that one must have perseverance when faced with difficulties. Never, never give up. Stay curious and hungry. You’ll never know how high you can fly until you stretch out your wings.